This month I've tried documenting my expenses in a new way, which so far I've been happy with. Though Excel spreadsheets do have their advantages, I've gone back to the basics: a handwritten list in a lined notebook. I prefer having a hardcopy and find it easier to quickly jot down expenses in a book when I come home from grocery shopping, rather than get out my laptop.

For my expense record book I chose a simple 80-page Hilroy coil notebook, which cost me a full 5 cents at Walmart's back-to-school sale. It has full-sized (10.5'' x 8'') pages, which are just the right size to accommodate my four columns of information.

At the top right corner of the page I write the month and year (e.g. Aug. 2014). Across the top of the page I write four column headers: date, amount, store, and note.

Then all that remains is filling it in! I make my first few entries my regular bigger monthly expenses (namely rent, internet, and cellphone).

The rest follow in chronological order. Since I pay for most things by credit card, a "tender" column is unnecessary for me; if I do happen to pay cash for something I just note "(cash)" following the dollar amount. I use the "note" column occasionally to remind myself of what an amount represents.

Anytime I come home from spending money (shopping, gas, parking, etc.) I get the receipts out and add the data to my expense record book. It's best to be diligent at doing this, so your record remains accurate and doesn't become a burden to complete at a later time.

What are the benefits of maintaining an expense record?

- When it comes to checking your credit card statement, it's quicker to compare it side-by-side to a chronologically-ordered expense record than rifle through receipts. (That being said, make sure you still keep all receipts in case there is a price discrepancy that needs to be followed up on or if there is any chance you may return the item.)

- It provides a quick overview of how much you are spending. For budgeting purposes, it's important to know where your money is going. At the end of each month you can use different coloured highlighting to classify expenses (e.g. groceries, restaurants, clothing, entertainment), to analyze how much you are spending on each.

Income Record

I don't maintain an income record as currently my income comes from one source and is deposited twice monthly directly into my bank account. I have an online record of both my bank statements and pay stubs, so if I needed to I could quite easily make a list of income amounts. For budgeting purposes though, it may be helpful to record monthly income at the end of the monthly expense record, to see how the two compare.

Accounts

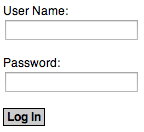

How many accounts to you have? Probably more than you realize! These days we have accounts for email, banking, credit cards, internet, cellphone, online shopping, social networking, airmiles, professional associations, university, and work, among many other things. After having to click "forgot password" for the umpteenth time, I decided I needed a way to keep track of these data.

How many accounts to you have? Probably more than you realize! These days we have accounts for email, banking, credit cards, internet, cellphone, online shopping, social networking, airmiles, professional associations, university, and work, among many other things. After having to click "forgot password" for the umpteenth time, I decided I needed a way to keep track of these data.I started by recording this information as memos on my cell phone. However, it became cluttered to scroll through. I also wanted a more permanent medium. The answer was a small dollar-store hardcover notebook.

Each time I register for something I get out my notebook to record the information that I am bound to forget: username, account number, password, security questions, which of my email addresses I used to register, and anything else that may be of importance. This both preempts frustration and provides a reference for quick access of data (e.g. when asked for my internet account number during a customer service phone call, I knew exactly where to find it).

Initially I was hesitant to write this information down, concerned about security. The risk of someone gaining access to your information can be reduced by common sense measures: find an out-of-the-way storage place in your home for the book, take care not to leave it lying around, and make sure it contains your contact information so that it may be returned if lost. Furthermore, rather than writing down passwords you may choose to jot down hints that remind you of the passwords.

There are still a few things that I find useful to have recorded on my cellphone for easy access (e.g. employee number, banking information for direct deposit, etc.). However, be cautious about what you put on your phone; ideally, it should be password-protected.

No comments:

Post a Comment